News provided byTechnavio

Sep 16, 2024, 14:30 ET

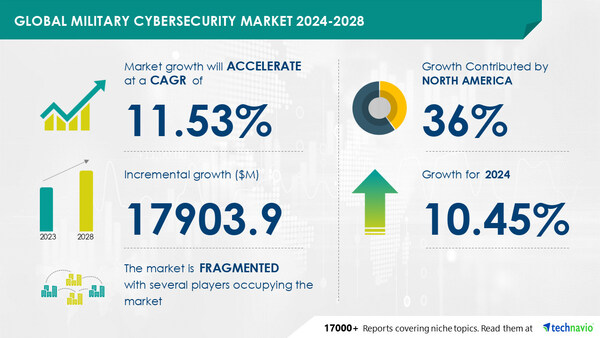

NEW YORK, Sept. 16, 2024 /PRNewswire/ — Report on how AI is driving market transformation- The global military cybersecurity market size is estimated to grow by USD 17.90 billion from 2024-2028, according to Technavio. The market is estimated to grow at a CAGR of 11.53% during the forecast period. Increase in adoption of cloud-based services is driving market growth, with a trend towards high adoption of AI and machine learning. However, system integration and interoperability issues poses a challenge. Key market players include Airbus SE, BAE Systems Plc, Booz Allen Hamilton Holding Corp., Broadcom Inc., CACI International Inc., Cisco Systems Inc., Digital Management LLC, Fortinet Inc., General Dynamics Corp., GovCIO, Intel Corp., International Business Machines Corp., Leidos Holdings Inc., Lockheed Martin Corp., ManTech International Corp., NetCentrics Corp., Northrop Grumman Corp., RTX Corp., SAIC Motor Corp. Ltd., Thales Group, and Viasat Inc..

Key insights into market evolution with AI-powered analysis. Explore trends, segmentation, and growth drivers- View the snapshot of this report

| Military Cybersecurity Market Scope | |

| Report Coverage | Details |

| Base year | 2023 |

| Historic period | 2018 – 2022 |

| Forecast period | 2024-2028 |

| Growth momentum & CAGR | Accelerate at a CAGR of 11.53% |

| Market growth 2024-2028 | USD 17903.9 million |

| Market structure | Fragmented |

| YoY growth 2022-2023 (%) | 10.45 |

| Regional analysis | North America, APAC, Europe, Middle East and Africa, and South America |

| Performing market contribution | North America at 36% |

| Key countries | US, China, India, Russia, and UK |

| Key companies profiled | Airbus SE, BAE Systems Plc, Booz Allen Hamilton Holding Corp., Broadcom Inc., CACI International Inc., Cisco Systems Inc., Digital Management LLC, Fortinet Inc., General Dynamics Corp., GovCIO, Intel Corp., International Business Machines Corp., Leidos Holdings Inc., Lockheed Martin Corp., ManTech International Corp., NetCentrics Corp., Northrop Grumman Corp., RTX Corp., SAIC Motor Corp. Ltd., Thales Group, and Viasat Inc. |

Market Driver

The integration of Artificial Intelligence (AI) and machine learning in military cybersecurity is anticipated to significantly contribute to economic growth, particularly in developed economies. Developed countries are adopting AI-based solutions at a faster pace due to their advanced infrastructure. Machine learning, a subset of AI, delivers outputs similar to humans without extensive programming. Technologies like autonomous vehicles, speech recognition, and advanced web searches utilize machine learning. Extensive research and development activities are ongoing in this field. As AI replaces human monitoring and analysis, human error is reduced, leading to more effective cybersecurity solutions. This enhancement is projected to fuel the expansion of the global military cybersecurity market.

Military cybersecurity is a critical issue as military systems, networks, and infrastructure face increasing threats from cyber attacks. Unauthorized access, espionage, and malicious activities pose risks to military operations and defense organizations. State-sponsored attacks and cyber warfare are major concerns. Defense budgets continue to grow to fund cybersecurity measures, including cloud computing solutions from cybersecurity companies. Threat intelligence, incident response, machine learning, and quantum-resistant cryptography are essential security solutions. Defense organizations must also secure their supply chains and communication networks. Cybersecurity norms, cloud-based storage solutions, and investments by governments are driving innovation in areas like autonomous defense, blockchain, space operations, and security professional services. The Biden-Harris Administration prioritizes military cybersecurity, focusing on training and education, deployment modes, data security, application security, cloud security, and endpoint security. Defense personnel require ongoing training to counter evolving threats.

Request Sample of our comprehensive report now to stay ahead in the AI-driven market evolution!

Market Challenges

- The military sector’s increasing adoption of advanced technologies brings about the need for network security solutions. However, defense agencies encounter challenges in integrating these solutions with their existing IT infrastructure. Vendors must offer unified IT solutions to ensure seamless integration. Technical issues during operations can result in significant costs and reduced efficiency. Hacking-related malfunctions, such as server errors and technical defects, pose a threat. To mitigate these risks, vendors must conduct rigorous trials before market introduction. Integration of multiple IT systems on traditional infrastructure can lead to cross-platform issues, potentially hindering military cybersecurity implementation and market growth.

- Military organizations face unique cybersecurity challenges in areas like supply chain security, threat intelligence, incident response, and defense security norms. Machine learning and quantum-resistant cryptography help strengthen network, endpoint, application, data, cloud, and communication security. Cyber-physical systems, autonomous defense, blockchain, and space operations require specialized solutions. Biden-Harris Administration’s focus on cybersecurity includes investments in cybersecurity technologies, professional services, training, and education. Challenges include hacking, import/export analysis, and compliance with defense security norms. Cloud-based storage solutions, security services, and encryption are essential for data protection. Access controls, national security, and incident response are critical components of defense cybersecurity strategies. Military cybersecurity requires a multi-layered approach to address the evolving threat landscape. This includes deploying security solutions for various modes, implementing communication networks with intelligence and surveillance capabilities, and ensuring supply chain security. Defense personnel need ongoing training to stay updated on the latest cybersecurity trends and best practices. Defense budgets continue to increase for cybersecurity initiatives, with investments in unmanned vehicles, cloud-based storage solutions, and security services.

Discover how AI is revolutionizing market trends- Get your access now!

Segment Overview

This military cybersecurity market report extensively covers market segmentation by

- Deployment

- 1.1 On-premise

- 1.2 Cloud-based

- Type

- 2.1 Network security

- 2.2 Data security

- 2.3 Identity and access management

- 2.4 Cloud security

- Geography

- 3.1 North America

- 3.2 APAC

- 3.3 Europe

- 3.4 Middle East and Africa

- 3.5 South America

1.1 On-premise- The on-premises segment dominated the global military cybersecurity market in 2022, accounting for the largest share. On-premises security solutions run on an organization’s own hardware infrastructure, enabling defense institutions to purchase licenses for cybersecurity software to operate on their local servers. The primary advantage of on-premises systems is data protection, as data is stored locally, granting end-users complete control. Military organizations maintain full authority over their network security without external interference. Although the demand for on-premises systems has decreased due to the rise of cloud-based alternatives, concerns regarding security, compliance, and network control continue to drive market growth.

Download a Sample of our comprehensive report today to discover how AI-driven innovations are reshaping competitive dynamics

Research Analysis

The Military Cybersecurity Market encompasses the protective measures implemented to safeguard military systems, networks, and infrastructure from cyber threats. With the increasing reliance on technology for military operations, unauthorized access, espionage, and malicious activities pose significant risks. Defense organizations face threats from state-sponsored attacks, hacking, and import/export analysis. To counter these risks, governments are making substantial investments in cybersecurity technologies, including cloud-based storage solutions, encryption, access controls, and security services. The Biden-Harris Administration has prioritized cybersecurity, recognizing its importance to national security. Unmanned vehicles and defense personnel also require protection. The defense budget reflects this priority, with a growing allocation towards cybersecurity. Cybersecurity is essential to maintaining the integrity and confidentiality of military information, ensuring the safety of defense personnel, and preserving national security.

Market Research Overview

The Military Cybersecurity market encompasses the protection of Military systems, networks, and infrastructure from Cyber threats such as unauthorized access, espionage, malicious activities, and state-sponsored attacks. Cybersecurity measures are essential to safeguard Military operations and defense organizations from Cyber warfare. Defense budgets continue to prioritize Cybersecurity, with investments in Cloud computing, Cybersecurity companies, and advanced technologies like Machine learning, Quantum-resistant cryptography, Blockchain, and Autonomous defense. Military cybersecurity extends to securing Cyber-physical systems, communication networks, Intelligence and surveillance, and Supply chain. Defense organizations face various threats, including hacking, import/export analysis, and encryption breaches. Access controls and National security are paramount, with a focus on Cloud-based storage solutions, Security services, and Cybersecurity technologies. Personnel training and education are crucial, with deployment modes varying from on-premises to Cloud-based solutions. The Biden-Harris Administration has focued Military cybersecurity, with Defense personnel receiving increased training and education. Defense budgets continue to allocate funds for Cybersecurity, with a focus on securing Space operations, Unmanned vehicles, and Defense personnel. Cybersecurity norms and regulations are evolving, with a growing emphasis on Threat intelligence, Incident response, and Deployment modes.

Table of Contents:

1 Executive Summary

2 Market Landscape

3 Market Sizing

4 Historic Market Size

5 Five Forces Analysis

6 Market Segmentation

- Deployment

- On-premise

- Cloud-based

- Type

- Network Security

- Data Security

- Identity And Access Management

- Cloud Security

- Geography

- North America

- APAC

- Europe

- Middle East And Africa

- South America

7 Customer Landscape

8 Geographic Landscape

9 Drivers, Challenges, and Trends

10 Company Landscape

11 Company Analysis

12 Appendix

About Technavio

Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions.

With over 500 specialized analysts, Technavio’s report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio’s comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Contacts

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email: media@technavio.com

Website: www.technavio.com/

SOURCE Technavio