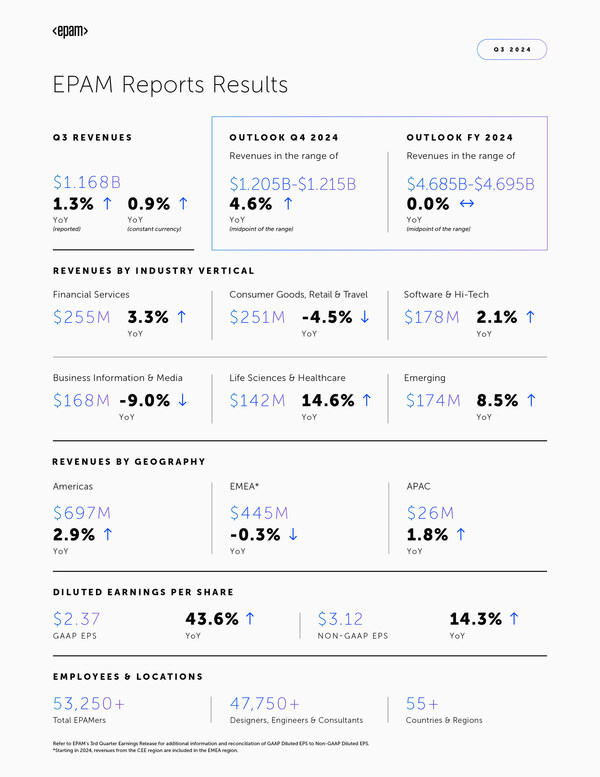

- Third quarter revenues of $1.168 billion, up 1.3% year-over-year

- GAAP income from operations was 15.2% of revenues and non-GAAP income from operations was 19.1% of revenues for the third quarter

- Third quarter GAAP diluted EPS of $2.37, an increase of $0.72, and non-GAAP diluted EPS of $3.12, an increase of $0.39 on a year-over-year basis

- For the full year, EPAM increases expected range for revenues to now be $4.685 billion to $4.695 billion, increases expected GAAP diluted EPS to now be in the range of $7.78 to $7.86 and non-GAAP diluted EPS to now be in the range of $10.73 to $10.81

- For the fourth quarter, EPAM expects revenues to be in the range of $1.205 billion to $1.215 billion, GAAP diluted EPS to be in the range of $1.73 to $1.81 and non-GAAP diluted EPS to be in the range of $2.70 to $2.78

NEWTOWN, Pa., Nov. 7, 2024 /PRNewswire/ — EPAM Systems, Inc. (NYSE: EPAM), a leading digital transformation services and product engineering company, today announced results for the third quarter ended September 30, 2024.

“We are pleased with our strong third-quarter results and the ongoing improvement across our business. We continue to help our clients adapt and modernize their businesses, including deploying world-class solutions enabled by GenAI,” said Arkadiy Dobkin, CEO & President at EPAM. “Our recent acquisition of NEORIS illustrates our strong commitment to diversifying our global delivery platform and our readiness to enter new markets to best serve our enterprise clients.”

Third Quarter 2024 Highlights

- Revenues increased to $1.168 billion, a year-over-year increase of $15.4 million, or 1.3%. On an organic constant currency basis excluding the impact of the exit from Russia, revenues were down 0.3% compared to the third quarter of 2023;

- We recorded a benefit of $52.0 million for research & development government incentives in Poland. Specifically, $22.9 million of the benefit related to activities performed during 2023 and $29.1 million of the benefit related to activities performed during the first nine months of 2024. This benefit was included as a reduction to our Cost of revenues. The incentives are granted under Polish law, which allows businesses to reduce their tax base through bonus deductions for certain costs, including compensation expenses, incurred while performing innovative activities. The impact of this benefit on net income was partially offset as the incentives drove a higher effective tax rate for both GAAP and non-GAAP results. We expect the incentive will be recurring with benefits recognized in the fourth quarter and continuing thereafter.

- GAAP income from operations was $177.0 million, an increase of $63.0 million, or 55.2%, compared to $114.0 million in the third quarter of 2023. GAAP income from operations benefited from the recognition of $52.0 million of incentives related to research and development activities performed in Poland;

- Non-GAAP income from operations was $222.9 million, an increase of $27.3 million, or 14.0%, compared to $195.6 million in the third quarter of 2023. Non-GAAP income from operations benefited from the recognition of $29.1 million of incentives related to research and development activities performed in Poland in 2024;

- Diluted earnings per share (“EPS”) on a GAAP basis was $2.37, an increase of $0.72, or 43.6%, compared to $1.65 in the third quarter of 2023. EPS on a GAAP basis was positively impacted by the recognition of the Polish incentives, which increased income from operations. However, this benefit was partially offset by an increase to the effective tax rate;

- Non-GAAP diluted EPS was $3.12, an increase of $0.39, or 14.3%, compared to $2.73 in the third quarter of 2023. EPS on a non-GAAP basis was positively impacted by the recognition of the Polish incentives for activities performed during the first nine months of 2024, which increased income from operations. However, this benefit was partially offset by an increase to the effective tax rate; and

- On November 1, 2024, EPAM completed its acquisition of NEORIS, a Miami-headquartered global advanced technology consultancy with approximately 4,800 professionals across major talent hubs in Latin America, Spain and the U.S.

Cash Flow and Other Metrics

- Cash provided by operating activities was $428.9 million for the first nine months of 2024, compared to cash provided by operating activities of $391.3 million for the first nine months of 2023;

- Cash, cash equivalents and restricted cash totaled $2.041 billion as of September 30, 2024, a decrease of $2.4 million, or 0.1%, from $2.043 billion as of December 31, 2023; and

- Total headcount was approximately 53,250 as of September 30, 2024. Included in this number were approximately 47,750 delivery professionals, an increase of 1.6% from June 30, 2024.

2024 Outlook – Full Year and Fourth Quarter

Full Year

The outlook reflects the impact of closed acquisitions including NEORIS. We have not included the impact of the pending acquisition of First Derivative. EPAM now expects the following for the full year:

- The Company now expects revenues to be $4.685 billion to $4.695 billion for the full year reflecting flat year-over-year growth at the midpoint of the range. Included in the outlook is an inorganic revenue contribution of 2.4% of which 1.2% comes from NEORIS which was acquired on November 1, 2024. The Company now expects revenues on an organic constant currency basis excluding the impact of the exit from Russia will decline 2.3% at the midpoint of the range;

- For the full year, EPAM expects GAAP income from operations to now be in the range of 11.0% to 11.5% of revenues and non-GAAP income from operations to now be in the range of 16.0% to 16.5% of revenues;

- The Company expects its GAAP effective tax rate to now be approximately 23% and continues to expect its non-GAAP effective tax rate to be approximately 24%; and

- EPAM expects GAAP diluted EPS to now be in the range of $7.78 to $7.86 and non-GAAP diluted EPS to now be in the range of $10.73 to $10.81. The Company continues to expect weighted average diluted shares outstanding for the year to be 57.9 million.

Fourth Quarter

The outlook reflects the impact of closed acquisitions including NEORIS. We have not included the impact of the pending acquisition of First Derivative. EPAM expects the following for the fourth quarter:

- The Company expects revenues will be in the range of $1.205 billion to $1.215 billion for the fourth quarter reflecting year-over-year growth of 4.6% at the midpoint of the range. Included in the outlook is an inorganic revenue contribution of 5.7% of which 4.7% comes from NEORIS which was acquired on November 1, 2024. The Company expects that revenues on an organic constant currency basis excluding the impact of the exit from Russia will decline 1.5% at the midpoint of the range;

- For the fourth quarter, EPAM expects GAAP income from operations to be in the range of 10.5% to 11.5% of revenues and non-GAAP income from operations to be in the range of 16.0% to 17.0% of revenues. Included in the outlook for both GAAP and non-GAAP is a $9.0 million benefit from the Poland R&D incentive;

- The Company expects its GAAP effective tax rate to be approximately 26% and its non-GAAP effective tax rate to be approximately 24%; and

- EPAM expects GAAP diluted EPS will be in the range of $1.73 to $1.81 for the quarter, and non-GAAP diluted EPS will be in the range of $2.70 to $2.78 for the quarter. The Company expects weighted average diluted shares outstanding for the quarter to be 57.2 million.

Conference Call Information

EPAM will host a conference call to discuss the results on Thursday, November 7, 2024, at 8:00 a.m. EDT. The conference call will be available live on the EPAM website at https://investors.epam.com. Please visit the website at least 15 minutes prior to the call to register for the event. For those who cannot access the live webcast, a replay will be available in the Investor Relations section of the website.

About EPAM Systems

Since 1993, EPAM Systems, Inc. (NYSE: EPAM) has used its software engineering expertise to become a leading global provider of digital engineering, cloud and AI-enabled transformation services, and a leading business and experience consulting partner for global enterprises and ambitious startups. We address our clients’ transformation challenges by focusing EPAM Continuum’s integrated strategy, experience and technology consulting with our 30+ years of engineering execution to speed our clients’ time to market and drive greater value from their innovations and digital investments.

We make GenAI real with our AI LLM orchestration, testing and engineering solutions, EPAM DIAL, EPAM EliteA™ and EPAM AI/RUN™, respectively.

We deliver globally but engage locally with our expert teams of consultants, architects, designers and engineers, making the future real for our clients, our partners, and our people around the world. We believe the right solutions are the ones that improve people’s lives and fuel competitive advantage for our clients across diverse industries. Our thinking comes to life in the experiences, products and platforms we design and bring to market.

Added to the S&P 500 and the Forbes Global 2000 in 2021 and recognized by Glassdoor and Newsweek as a Top 100 Best Workplace, our multidisciplinary teams serve customers across six continents. We are proud to be among the top 15 companies in Information Technology Services in the Fortune 1000 and to be recognized as a leader in the IDC MarketScapes for Worldwide Experience Build Services, Worldwide Experience Design Services and Worldwide Software Engineering Services.

Learn more at www.epam.com and follow us on LinkedIn.

Non-GAAP Financial Measures

EPAM supplements results reported in accordance with United States generally accepted accounting principles, referred to as GAAP, with non-GAAP financial measures. Management believes these measures help illustrate underlying trends in EPAM’s business and uses the measures to establish budgets and operational goals, communicate internally and externally, for managing EPAM’s business and evaluating its performance. Management also believes these measures help investors compare EPAM’s operating performance with its results in prior periods. EPAM anticipates that it will continue to report both GAAP and certain non-GAAP financial measures in its financial results, including non-GAAP results that exclude stock-based compensation expenses, acquisition-related costs including amortization of acquired intangible assets, impairment of assets, expenses associated with EPAM’s humanitarian commitment to its professionals in Ukraine, unbilled business continuity resources resulting from Russia’s invasion of Ukraine, costs associated with the geographic repositioning of EPAM employees based outside of Ukraine impacted by the war and geopolitical instability in the region, employee separation costs incurred in connection with restructuring programs including the Company’s exit from Russia, certain other one-time charges and benefits, changes in fair value of contingent consideration, foreign exchange gains and losses, excess tax benefits related to stock-based compensation, and the related effect on income taxes of the pre-tax adjustments. Management also compares revenues on an “organic constant currency basis excluding the impact of the exit from Russia” and an “organic constant currency basis,” which are also non-GAAP financial measures. These measures exclude the effect of acquisitions by removing revenues from an acquired company in the twelve months after completing an acquisition and foreign currency exchange rate fluctuations by translating the current period revenues into U.S. dollars at the weighted average exchange rates of the prior period of comparison. In addition, revenues on an “organic constant currency basis excluding the impact of the exit from Russia” reflect the decision to exit from Russia by removing revenues from clients located in Russia in both the current period and prior period of comparison. Because EPAM’s reported non-GAAP financial measures are not calculated in accordance with GAAP, these measures are not comparable to GAAP and may not be comparable to similarly described non-GAAP measures reported by other companies within EPAM’s industry. Consequently, EPAM’s non-GAAP financial measures should not be evaluated in isolation or supplant comparable GAAP measures, but rather, should be considered together with the information in EPAM’s consolidated financial statements, which are prepared in accordance with GAAP.

Forward-Looking Statements

This press release includes estimates and statements which may constitute forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, the accuracy of which are necessarily subject to risks, uncertainties, and assumptions as to future events that may not prove to be accurate. Our estimates and forward-looking statements are mainly based on our current expectations and estimates of future events and trends, which affect or may affect our business and operations. These statements may include words such as “may,” “will,” “should,” “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate” or similar expressions. Those future events and trends may relate to, among other things, developments relating to the war in Ukraine and escalation of the war in the surrounding region, political and civil unrest or military action in the geographies where we conduct business and operate, difficult conditions in global capital markets, foreign exchange markets and the broader economy, and the effect that these events may have on client demand and our revenues, operations, access to capital, and profitability. Other factors that could cause actual results to differ materially from those expressed or implied include general economic conditions, the risk factors discussed in the Company’s most recent Annual Report on Form 10-K and the factors discussed in the Company’s Quarterly Reports on Form 10-Q, particularly under the headings “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors” and other filings with the Securities and Exchange Commission. Although we believe that these estimates and forward-looking statements are based upon reasonable assumptions, they are subject to several risks and uncertainties and are made based on information currently available to us. EPAM undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as may be required under applicable securities law.

| EPAM SYSTEMS, INC. AND SUBSIDIARIES | |||||||

| CONDENSED CONSOLIDATED STATEMENTS OF INCOME | |||||||

| (Unaudited) | |||||||

| (In thousands, except per share data) | |||||||

| Three Months EndedSeptember 30, | Nine Months EndedSeptember 30, | ||||||

| 2024 | 2023 | 2024 | 2023 | ||||

| Revenues | $ 1,167,527 | $ 1,152,136 | $ 3,479,589 | $ 3,533,283 | |||

| Operating expenses: | |||||||

| Cost of revenues (exclusive of depreciation and amortization) | 763,992 | 794,265 | 2,409,183 | 2,458,881 | |||

| Selling, general and administrative expenses | 206,820 | 194,829 | 599,331 | 601,093 | |||

| Depreciation and amortization expense | 19,736 | 23,092 | 63,003 | 68,642 | |||

| Loss on sale of business | — | 25,922 | — | 25,922 | |||

| Income from operations | 176,979 | 114,028 | 408,072 | 378,745 | |||

| Interest and other income, net | 13,347 | 13,931 | 40,425 | 37,162 | |||

| Foreign exchange (loss)/gain | (710) | 3,893 | (1,416) | (6,725) | |||

| Income before provision for income taxes | 189,616 | 131,852 | 447,081 | 409,182 | |||

| Provision for income taxes | 53,270 | 34,648 | 95,847 | 89,653 | |||

| Net income | $ 136,346 | $ 97,204 | $ 351,234 | $ 319,529 | |||

| Net income per share: | |||||||

| Basic | $ 2.40 | $ 1.68 | $ 6.11 | $ 5.52 | |||

| Diluted | $ 2.37 | $ 1.65 | $ 6.04 | $ 5.40 | |||

| Shares used in calculation of net income per share: | |||||||

| Basic | 56,910 | 57,853 | 57,445 | 57,850 | |||

| Diluted | 57,425 | 58,948 | 58,166 | 59,143 | |||

| EPAM SYSTEMS, INC. AND SUBSIDIARIES | |||

| CONDENSED CONSOLIDATED BALANCE SHEETS | |||

| (Unaudited) | |||

| (In thousands, except par value) | |||

| As ofSeptember 30,2024 | As ofDecember 31,2023 | ||

| Assets | |||

| Current assets | |||

| Cash and cash equivalents | $ 2,036,394 | $ 2,036,235 | |

| Trade receivables and contract assets, net of allowance of $5,864 and $11,864, respectively | 935,077 | 897,032 | |

| Short-term investments | 22,316 | 60,739 | |

| Prepaid and other current assets | 113,069 | 97,355 | |

| Total current assets | 3,106,856 | 3,091,361 | |

| Property and equipment, net | 207,502 | 235,053 | |

| Operating lease right-of-use assets, net | 129,929 | 134,898 | |

| Intangible assets, net | 74,494 | 71,118 | |

| Goodwill | 621,903 | 562,459 | |

| Deferred tax assets | 218,320 | 197,901 | |

| Other noncurrent assets | 98,193 | 59,575 | |

| Total assets | $ 4,457,197 | $ 4,352,365 | |

| Liabilities | |||

| Current liabilities | |||

| Accounts payable | $ 30,774 | $ 31,992 | |

| Accrued compensation and benefits expenses | 422,548 | 412,747 | |

| Accrued expenses and other current liabilities | 155,817 | 124,823 | |

| Income taxes payable, current | 34,346 | 38,812 | |

| Operating lease liabilities, current | 37,561 | 36,558 | |

| Total current liabilities | 681,046 | 644,932 | |

| Long-term debt | 25,331 | 26,126 | |

| Operating lease liabilities, noncurrent | 102,551 | 109,261 | |

| Other noncurrent liabilities | 93,640 | 100,576 | |

| Total liabilities | 902,568 | 880,895 | |

| Commitments and contingencies | |||

| Equity | |||

| Stockholders’ equity | |||

| Common stock, $0.001 par value; 160,000 shares authorized; 56,708 shares issued and outstanding at September 30, 2024, and 57,787 shares issued and outstanding at December 31, 2023 | 57 | 58 | |

| Additional paid-in capital | 1,129,238 | 1,008,766 | |

| Retained earnings | 2,465,269 | 2,501,107 | |

| Accumulated other comprehensive loss | (40,517) | (39,040) | |

| Total EPAM Systems, Inc. stockholders’ equity | 3,554,047 | 3,470,891 | |

| Noncontrolling interest in consolidated subsidiaries | 582 | 579 | |

| Total equity | 3,554,629 | 3,471,470 | |

| Total liabilities and equity | $ 4,457,197 | $ 4,352,365 | |

| EPAM SYSTEMS, INC. AND SUBSIDIARIES | |||

| Reconciliations of Non-GAAP Financial Measures to Comparable GAAP Financial Measures | |||

| (Unaudited) | |||

| (In thousands, except percent and per share amounts) | |||

| Reconciliation of revenue growth/(decline) as reported on a GAAP basis to revenue decline on an organic constant currency basis excluding the impact of the exit from Russia is presented in the table below: | |||

| Three Months EndedSeptember 30, 2024 | Nine Months EndedSeptember 30, 2024 | ||

| Revenue growth/(decline) as reported | 1.3 % | (1.5) % | |

| Foreign exchange rates impact | (0.4) % | (0.3) % | |

| Inorganic revenue growth | (1.4) % | (1.3) % | |

| Impact of exit from Russia | 0.2 % | 0.4 % | |

| Revenue decline on an organic constant currency basis excluding the impact of the exit from Russia | (0.3) % | (2.7) % | |

| Reconciliation of various income statement amounts from GAAP to non-GAAP for the three and nine months ended September 30, 2024 and 2023: |

| Three Months EndedSeptember 30, 2024 | Nine Months EndedSeptember 30, 2024 | ||||||||||

| GAAP | Adjustments | Non-GAAP | GAAP | Adjustments | Non-GAAP | ||||||

| Cost of revenues (exclusive of depreciation and amortization)(1) | $ 763,992 | $ 2,739 | $ 766,731 | $ 2,409,183 | $ (37,781) | $ 2,371,402 | |||||

| Selling, general and administrative expenses(2) | $ 206,820 | $ (42,979) | $ 163,841 | $ 599,331 | $ (107,692) | $ 491,639 | |||||

| Income from operations(3) | $ 176,979 | $ 45,947 | $ 222,926 | $ 408,072 | $ 162,950 | $ 571,022 | |||||

| Operating margin | 15.2 % | 3.9 % | 19.1 % | 11.7 % | 4.7 % | 16.4 % | |||||

| Net income(4) | $ 136,346 | $ 42,740 | $ 179,086 | $ 351,234 | $ 115,364 | $ 466,598 | |||||

| Diluted earnings per share | $ 2.37 | $ 3.12 | $ 6.04 | $ 8.02 | |||||||

| Three Months EndedSeptember 30, 2023 | Nine Months EndedSeptember 30, 2023 | ||||||||||

| GAAP | Adjustments | Non-GAAP | GAAP | Adjustments | Non-GAAP | ||||||

| Cost of revenues (exclusive of depreciation and amortization)(1) | $ 794,265 | $ (21,146) | $ 773,119 | $ 2,458,881 | $ (67,281) | $ 2,391,600 | |||||

| Selling, general and administrative expenses(2) | $ 194,829 | $ (28,828) | $ 166,001 | $ 601,093 | $ (76,021) | $ 525,072 | |||||

| Income from operations(3) | $ 114,028 | $ 81,584 | $ 195,612 | $ 378,745 | $ 185,932 | $ 564,677 | |||||

| Operating margin | 9.9 % | 7.1 % | 17.0 % | 10.7 % | 5.3 % | 16.0 % | |||||

| Net income(4) | $ 97,204 | $ 63,876 | $ 161,080 | $ 319,529 | $ 144,344 | $ 463,873 | |||||

| Diluted earnings per share | $ 1.65 | $ 2.73 | $ 5.40 | $ 7.84 | |||||||

| Items (1) through (4) above are detailed in the table below with the specific cross-reference noted in the appropriate item. |

| Three Months EndedSeptember 30, | Nine Months EndedSeptember 30, | ||||||

| 2024 | 2023 | 2024 | 2023 | ||||

| Stock-based compensation expenses | $ 19,576 | $ 18,142 | $ 58,870 | $ 49,569 | |||

| Poland R&D incentives(a) | (22,917) | — | (22,917) | — | |||

| Humanitarian support in Ukraine(b) | 602 | 3,004 | 1,828 | 8,297 | |||

| Unbilled business continuity resources(c) | — | — | — | 9,415 | |||

| Total adjustments to GAAP cost of revenues(1) | (2,739) | 21,146 | 37,781 | 67,281 | |||

| Stock-based compensation expenses | 22,548 | 19,705 | 63,729 | 59,967 | |||

| Cost Optimization charges(d) | 9,903 | 7,116 | 26,433 | 7,116 | |||

| Other acquisition-related expenses | 7,098 | 867 | 8,777 | 2,448 | |||

| Humanitarian support in Ukraine(b) | 2,955 | 643 | 7,694 | 5,309 | |||

| Geographic repositioning(e) | 28 | 435 | 853 | 877 | |||

| One-time charges, net | 447 | 62 | 206 | 304 | |||

| Total adjustments to GAAP selling, general and administrative expenses(2) | 42,979 | 28,828 | 107,692 | 76,021 | |||

| Amortization of acquired intangible assets | 5,707 | 5,688 | 17,477 | 16,708 | |||

| Loss on sale of business(f) | — | 25,922 | — | 25,922 | |||

| Total adjustments to GAAP income from operations(3) | 45,947 | 81,584 | 162,950 | 185,932 | |||

| Foreign exchange loss/(gain) | 710 | (3,893) | 1,416 | 6,725 | |||

| One-time benefit included in Interest and other income, net | (1,812) | — | (1,812) | — | |||

| Change in fair value of contingent consideration included in Interest and other income, net | 1,492 | 300 | 4,027 | 1,818 | |||

| Provision for income taxes: | |||||||

| Tax effect on non-GAAP adjustments | (3,855) | (12,395) | (28,882) | (34,060) | |||

| Tax shortfall/(excess tax benefits) related to stock-based compensation | 258 | (1,720) | (20,505) | (15,103) | |||

| Net discrete benefit from tax planning(g) | — | — | (1,830) | (968) | |||

| Total adjustments to GAAP net income(4) | $ 42,740 | $ 63,876 | $ 115,364 | $ 144,344 | |||

| (a) We have excluded from non-GAAP results the portion of the benefit from Poland R&D incentives related to qualifying activities performed in 2023 as it represents a nonrecurring one-time benefit. |

| (b) Humanitarian support in Ukraine includes expenses related to EPAM’s $100 million humanitarian commitment in response to Russia’s invasion of Ukraine to support EPAM professionals and their families in and displaced from Ukraine. These expenses are incremental to those expenses incurred prior to the crisis, clearly separable from normal operations, and not expected to recur once the crisis has subsided and operations return to normal. |

| (c) Given the uncertainty in the region introduced by Russia’s invasion of Ukraine, EPAM has assigned delivery professionals in locations outside of the region to ensure the continuity of delivery for clients who have substantial delivery exposure to Ukraine or other delivery concerns resulting from the invasion. These employees are not billed to clients and operate largely in a standby or backup capacity. These expenses are incremental to those expenses incurred prior to the crisis, clearly separable from normal operations, and not expected to recur once the crisis has subsided and operations return to normal. |

| (d) Cost Optimization charges include severance, facilities and contract termination charges incurred in connection with the programs initiated in the third quarter of 2023 and second quarter of 2024. Consistent with the Company’s historical non-GAAP policy, costs incurred in connection with formal restructuring initiatives have been excluded from non-GAAP results as these are one-time and unusual in nature. |

| (e) Geographic repositioning includes expenses associated with the relocation to other countries of employees based outside of Ukraine impacted by the war and geopolitical instability in the region, and includes the cost of accommodations, travel and food. These expenses are incremental to those expenses incurred prior to the crisis, clearly separable from normal operations, and not expected to recur once the crisis has subsided and operations return to normal. |

| (f) On July 26, 2023, the Company completed the sale of its remaining operations in Russia and recorded a loss on sale of approximately $25.9 million during the third quarter of 2023, including the recognition of the accumulated currency translation loss related to this foreign entity that was previously included in Accumulated other comprehensive loss in the condensed consolidated financial statements. The Company excluded this loss from non-GAAP results as it is one-time and unusual in nature. |

| (g) One-time benefit related to the implementation of tax planning to disregard certain foreign subsidiaries as separate entities for U.S. income tax purposes. Consistent with the Company’s historical non-GAAP policy, the benefit related to the implementation of tax planning has been excluded from non-GAAP results as it is one-time and unusual in nature. |

| EPAM SYSTEMS, INC. AND SUBSIDIARIES | |||

| Reconciliations of Guidance Non-GAAP Financial Measures to Comparable GAAP Financial Measures | |||

| (Unaudited) | |||

| The below guidance constitutes forward-looking statements within the meaning of the federal securities laws and is based on a number of assumptions that are subject to change and many of which are outside the control of the Company. Actual results may differ materially from the Company’s expectations depending on factors discussed in the Company’s filings with the Securities and Exchange Commission. | |||

| Reconciliation of expected revenue growth on a GAAP basis to expected revenue decline on an organic constant currency basis excluding the impact of the exit from Russia is presented in the table below: | |||

| Fourth Quarter 2024 | Full Year 2024 | ||

| Revenue growth (at midpoint of the range) | 4.6 % | — % | |

| Foreign exchange rates impact | (0.3) % | (0.2) % | |

| Inorganic revenue growth | (5.7) % | (2.4) % | |

| Impact of exit from Russia | — % | 0.3 % | |

| Revenue decline on an organic constant currency basis excluding the impact of the exit from Russia (at midpoint of the range) | (1.4) % | (2.3) % | |

| Reconciliation of expected GAAP to non-GAAP income from operations as a percentage of revenues is presented in the table below: |

| Fourth Quarter 2024 | Full Year 2024 | ||

| GAAP income from operations as a percentage of revenues | 10.5% to 11.5% | 11.0% to 11.5% | |

| Stock-based compensation expenses | 3.6 % | 3.6 % | |

| Included in cost of revenues (exclusive of depreciation and amortization) | 1.7 % | 1.7 % | |

| Included in selling, general and administrative expenses | 1.9 % | 1.9 % | |

| Poland R&D incentives(a) | — | (0.5) % | |

| Humanitarian support in Ukraine(b) | 0.4 % | 0.3 % | |

| Cost Optimization charges(d) | 0.8 % | 0.7 % | |

| One-time charges and Other acquisition-related expenses(h) | — % | 0.3 % | |

| Amortization of acquired intangible assets | 0.7 % | 0.6 % | |

| Non-GAAP income from operations as a percentage of revenues | 16.0% to 17.0% | 16.0% to 16.5% |

| (h) EPAM has not included the impact of potential future One-time charges including asset impairments, unusual gains and losses, expenses incurred in connection with future cost optimization actions, and Other acquisition-related expenses because the Company is unable to predict these amounts with reasonable certainty. |

| Reconciliation of expected GAAP to non-GAAP effective tax rate is presented in the table below: |

| Fourth Quarter 2024 | Full Year 2024 | ||

| GAAP effective tax rate (approximately) | 26 % | 23 % | |

| Tax effect on non-GAAP adjustments | (1.6) % | (2.4) % | |

| (Tax shortfall)/excess tax benefits related to stock-based compensation | (0.4) % | 3.4 % | |

| Non-GAAP effective tax rate (approximately) | 24 % | 24 % |

| Reconciliation of expected GAAP to non-GAAP diluted earnings per share is presented in the table below: |

| Fourth Quarter 2024 | Full Year 2024 | ||

| GAAP diluted earnings per share | $1.73 to $1.81 | $7.78 to $7.86 | |

| Stock-based compensation expenses | 0.76 | 2.87 | |

| Included in cost of revenues (exclusive of depreciation and amortization) | 0.35 | 1.37 | |

| Included in selling, general and administrative expenses | 0.41 | 1.50 | |

| Poland R&D incentives(a) | — | (0.40) | |

| Humanitarian support in Ukraine(b) | 0.09 | 0.26 | |

| Cost Optimization charges(d) | 0.16 | 0.61 | |

| One-time charges and Other acquisition-related expenses(h) | 0.03 | 0.17 | |

| Amortization of acquired intangible assets | 0.15 | 0.45 | |

| Change in fair value of contingent consideration | — | 0.07 | |

| Foreign exchange loss | 0.02 | 0.04 | |

| Provision for income taxes: | |||

| Tax effect on non-GAAP adjustments | (0.25) | (0.74) | |

| Tax shortfall/(excess tax benefits) related to stock-based compensation | 0.01 | (0.35) | |

| Net discrete benefit from tax planning(g) | — | (0.03) | |

| Non-GAAP diluted earnings per share | $2.70 to $2.78 | $10.73 to $10.81 |

SOURCE EPAM Systems, Inc.